BEGINNER'S GUIDE

CoinbayUK is the easiest place to buy, sell, invest and manage your cryptocurrency portfolio.

What is a blockchain?

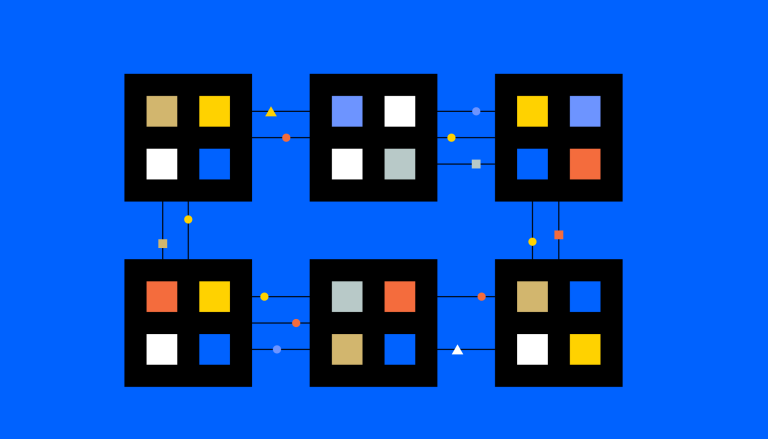

Cryptocurrencies like Bitcoin and Ethereum are powered by a technology called the blockchain. At its most basic, a blockchain is a list of transactions that anyone can view and verify. The Bitcoin blockchain, for example, contains a record of every time someone sent or received bitcoin. Cryptocurrencies and the blockchain technology that powers them make it possible to transfer value online without the need for a middleman like a bank or credit card company.

Imagine a global, open alternative to every financial service you use today, accessible with little more than a smartphone and internet connection.

Almost all cryptocurrencies, including Bitcoin, Ethereum Bitcoin Csh and Litecoin, are secured via blockchain networks. Which means their accuracy is constantly being verified by a huge amount of computing power.

The list of transactions contained in the blockchain is fundamental for most cryptocurrencies because it enables secure payments to be made between people who don’t know each other without having to go through a third-party verifier like a bank.

Due to the cryptographic nature of these networks, payments via blockchain can be more secure than standard debit/credit card transactions. When making a Bitcoin payment, for instance, you don’t need to provide any sensitive information. That means there is almost zero risk of your financial information being compromised, or your identity being stolen.

Blockchain technology is also exciting because it has many uses beyond cryptocurrency. Blockchains are being used to explore medical research, improve the accuracy of healthcare records, streamline supply chains, and so much more.

Due to the cryptographic nature of these networks, payments via blockchain can be more secure than standard debit/credit card transactions.

What are some advantages of blockchains?

They’re global: which means that cryptocurrencies can be sent across the planet quickly and cheaply.

They increase privacy: Cryptocurrency payments don’t require you to include your personal information, which protects you from being hacked or having your identity stolen.

They’re open: Because every single transaction on cryptocurrency networks is published publicly in the form of the blockchain, anyone can scrutinize them. That leaves no room for manipulation of transactions, changing the money supply, or adjusting the rules mid-game. The software that constitutes the core of these currencies is free and open-source so anyone can review the code.

Key questions

What’s the main advantage blockchains have over the old financial system?

Think about how much of your financial life takes place online, from shopping to investing – and how every single one of those transactions requires a bank or a credit card company or payment processor like Paypal in the middle of it. Blockchains allow for those transactions to happen without a middleman, and without the added costs and complexity that come with them.

Is Bitcoin a blockchain?

Bitcoin is a form of digital money. And the underlying technology that makes it possible is a blockchain.

How many kinds of blockchains are there?

Thousands, from the ones that power Bitcoin, Litecoin, Tezos, and countless other digital currencies to an increasing number that have nothing to do with digital money

How does a blockchain work?

Picture a chain you might use for a ship’s anchor. But in this case, every link on the chain is a chunk of information that contains transaction data. At the top of the chain you see what happened today, and as you move down the chain you see older and older transactions. And if you follow it all the way down to the anchor sitting at the bottom of the harbor? You’ll have seen every single transaction in the history of that cryptocurrency. Which gives the blockchain powerful security advantages: it’s an open, transparent record of a cryptocurrency’s entire history. If anyone tries to manipulate a transaction it will cause the link to break, and the entire network will see what happened. That, in a nutshell, is blockchain explained.

Another way people often describe the blockchain is that it’s a ledger (sometimes you’ll hear the terms ‘distributed ledger’ or ‘immutable ledger’), that is similar to the balance sheet of a bank. Like a bank’s ledger, the blockchain tracks all the money flowing into, out of, and through the network.

But unlike a bank’s books, a crypto blockchain isn’t maintained by any individual or organization, including banks and governments. In fact it isn’t centralized at all. Instead, it is secured by a large peer-to-peer network of computers running open-source software. The network is constantly checking and securing the accuracy of the blockchain.

Where does new cryptocurrency come from? Every so often – around every ten minutes in the case of Bitcoin – a new chunk of transaction information (or a new block) is added to the chain of existing information. In exchange for contributing their computing power to maintaining the blockchain, the network rewards participants with a small amount of digital currency.

A crypto blockchain is distributed across the digital currency’s entire network. No company, country, or third party is in control of it; and anyone can participate.

The network is constantly checking and securing the accuracy of the blockchain.

Key questions

How do you send and receive money over a blockchain?

The cryptocurrency network assigns each user a unique ‘address,’ which is made up of a private key and a public key. Anyone can send you money via your public key, which is akin to an email address. When you want to spend your money, you use your private key, which is basically your password, to digitally ‘sign’ transactions. The easiest way to manage your cryptocurrency is via software called a wallet, which you can get via an exchange like Coinbay.

Who invented the blockchain?

A person or group using the name Satoshi Nakamoto published a whitepaper online explaining the principles behind a new kind of digital money called Bitcoin in late 2008. Every cryptocurrency since is an evolution of the ideas laid out in that paper.

Nakamoto’s goal was to create digital money that would make online transactions between two strangers anywhere in the world possible without requiring a third party like a credit card company or a payment processor like Paypal in the middle.

This required a system that would eliminate a thorny issue called the ‘double spending’ problem, where a person might use the same money more than once. The solution is a network that is constantly verifying the movement of Bitcoin. That network is the blockchain.

Every Bitcoin transaction is stored and verified by a global network of computers beyond the control of any person, company, or country.

The database that holds all of that information is called the blockchain. Bitcoins are ‘mined’ via that huge, decentralized (also known as peer-to-peer) network of computers, which are also constantly verifying and securing the accuracy of the blockchain. In exchange for contributing their computing power to the blockchain, reliable and registered miners such as coinbayuk.com are rewarded with small amounts of cryptocurrency.

Every single bitcoin transaction is reflected on the ledger, with new information periodically gathered together in a “block,” which is added to all the blocks that came before.

The miners’ collective computing power is used to ensure the accuracy of the ever-growing ledger. Bitcoin can’t exist separately from the blockchain; each new bitcoin is recorded on it, as is each subsequent transaction with all existing coins.

In exchange for contributing their computing power to the blockchain, miners are rewarded with small amounts of cryptocurrency.

What’s the future of blockchains?

The blockchain idea has turned out to be a platform that a huge range of applications can be built on top of. It’s still a new and rapidly developing technology, but many experts have described blockchain’s potential to change the way we live and work as being similar to the potential public internet protocols like HTML had in the early days of the World Wide Web.

The Bitcoin Cash and Litecoin blockchains work in a very similar way to the original Bitcoin blockchain. The Ethereum blockchain is a further evolution of the distributed ledger idea, because unlike the Bitcoin blockchain it’s not solely designed to manage a digital money. (That said Ethereum is a cryptocurrency and certainly can be used to send value to another person). Think of the Ethereum blockchain more like a powerful and highly flexible computing platform that allows coders to easily build all kinds of applications leveraging the blockchain.

For example, imagine a charity that wants to send money to a thousand people every day for a year. With Ethereum, that would only take a few lines of code. Or maybe you’re a video game developer that wants to create items like swords and armor that can be traded outside of the game itself? Ethereum is designed to do that, too.

What is Bitcoin?

The world’s first widely-adopted cryptocurrency. With Bitcoin, people can securely and directly send each other digital money on the internet.

Bitcoin was created by Satoshi Nakamoto, a pseudonymous person or team who outlined the technology in a 2008 white paper. It’s an appealingly simple concept: bitcoin is digital money that allows for secure peer-to-peer transactions on the internet.

Unlike services like Venmo and PayPal, which rely on the traditional financial system for permission to transfer money and on existing debit/credit accounts, bitcoin is decentralized: any two people, anywhere in the world, can send bitcoin to each other without the involvement of a bank, government, or other institution.

Every transaction involving Bitcoin is tracked on the blockchain, which is similar to a bank’s ledger, or log of customers’ funds going in and out of the bank. In simple terms, it’s a record of every transaction ever made using bitcoin.

Unlike a bank’s ledger, the Bitcoin blockchain is distributed across the entire network. No company, country, or third party is in control of it; and anyone can become part of that network.

There will only ever be 21 million bitcoin. This is digital money that cannot be inflated or manipulated in any way.

It isn’t necessary to buy an entire bitcoin: you can buy just a fraction of one if that’s all you want or need.

Key Questions

What is BTC?

BTC is the abbreviation for bitcoin.

Is Bitcoin cryptocurrency?

Yes, bitcoin is the first widely adopted cryptocurrency, which is just another way of saying digital money.

Is there a simple bitcoin definition?

Bitcoin is digital money that allows secure and seamless peer-to-peer transactions on the internet.

What’s the price of bitcoin?

The current price of Bitcoin can be found on Coinbase’s website.

Is Bitcoin an investment opportunity?

Like any other asset, you can make money by buying BTC low and selling high, or lose money in the inverse scenario.

At what price did Bitcoin start?

One BTC was valued at a fraction of a U.S. penny in early 2010. During the first quarter of 2011, it exceeded a dollar. In late 2017, its value skyrocketed, topping out at close to $20,000. You can track the price of bitcoin here.

Bitcoin is digital money that allows for secure and seamless peer-to-peer transactions on the internet

Bitcoin Basics

Since Bitcoin’s creation, thousands of new cryptocurrencies have been launched, but bitcoin (abbreviated as BTC) remains the largest by market capitalization and trading volume.

Depending on your goals, bitcoin can function as

– an investment vehicle

– a store of value similar to gold

– a way to transfer value around the world

– even just a way to explore an emerging technology

Bitcoin is a currency native to the Internet. Unlike government-issued currencies such as the dollar or euro, Bitcoin allows online transfers without a middleman such as a bank or payment processor. The removal of those gatekeepers creates a whole range of new possibilities, including the potential for money to move around the global internet more quickly and cheaply, and allowing individuals to have maximum control over their own assets.

Bitcoin is legal to use, hold, and trade, and can be spent on everything from travel to charitable donations. It’s accepted as payment by businesses including Microsoft and Expedia.

Is bitcoin money? It’s been used as a medium of exchange, a store of value, and a unit of account—which are all properties of money. Meanwhile, it only exists digitally; there is no physical version of it.

Who created Bitcoin?

To really grasp how bitcoin works, it helps to start at the beginning. The question of who created bitcoin is a fascinating one, because a decade after inventing the technology—and despite a lot of digging by journalists and members of the crypto community—its creator remains anonymous.

The principles behind Bitcoin first appeared in a white paper published online in late 2008 by a person or group going by the name Satoshi Nakamoto.

This paper wasn’t the first idea for digital money drawing on the fields of cryptography and computer science—in fact, the paper referred to earlier concepts—but it was a uniquely elegant solution to the problem of establishing trust between different online entities, where people may be hidden (like bitcoin’s own creator) by pseudonyms, or physically located on the other side of the planet.

Nakamoto devised a pair of intertwined concepts: the bitcoin private key and the blockchain ledger. When you hold bitcoin, you control it through a private key—a string of randomized numbers and letters that unlocks a virtual vault containing your purchase. Each private key is tracked on the virtual ledger called the blockchain.

When Bitcoin first appeared, it marked a major advance in computer science, because it solved a fundamental problem of commerce on the internet: how do you transfer value between two people without a trusted intermediary (like a bank) in the middle? By solving that problem, the invention of bitcoin has wide-ranging ramifications: As a currency designed for the internet, it allows for financial transactions that range across borders and around the globe without the involvement of banks, credit-card companies, lenders, or even governments. When any two people—wherever they might live—can send payments to each other without encountering those gatekeepers, it creates the potential for an open financial system that is more efficient, more free, and more innovative. That, in a nutshell, is bitcoin explained.

Bitcoin creates the potential for an open financial system that is more efficient, more free, and more innovative.

How Bitcoin works

Unlike credit card networks like Visa and payment processors like Paypal, bitcoin is not owned by an individual or company. Bitcoin is the world’s first completely open payment network which anyone with an internet connection can participate in. Bitcoin was designed to be used on the internet, and doesn’t depend on banks or private companies to process transactions.

One of the most important elements of Bitcoin is the blockchain, which tracks who owns what, similar to how a bank tracks assets. What sets the Bitcoin blockchain apart from a bank’s ledger is that it is decentralized, meaning anyone can view it and no single entity controls it.

Here are some details about how it all works:

Specialized computers known as ‘mining rigs’ perform the equations required to verify and record a new transaction. In the early days, a typical desktop PC was powerful enough to participate, which allowed pretty much anyone who was curious to try their hand at mining. These days the computers required are massive, specialized, and often owned by businesses or large numbers of individuals pooling their resources. (In October 2019, it required 12 trillion times more computing power to mine one bitcoin than it did when Nakamoto mined the first blocks in January 2009.)

The miners’ collective computing power is used to ensure the accuracy of the ever-growing ledger. Bitcoin is inextricably tied to the blockchain; each new bitcoin is recorded on it, as is each subsequent transaction with all existing coins.

How does the network motivate miners to participate in the constant, essential work of maintaining the blockchain—verifying transactions? The Bitcoin network holds a continuous lottery in which all the mining rigs around the world race to be the first to solve a math problem. Every 10 min or so, a winner is found, and the winner updates the Bitcoin ledger with new valid transactions. The prize changes over time, but as of early 2020, each winner of this raffle was awarded 12.5 bitcoin.

At the beginning, a bitcoin was technically worthless. As of the end of 2019, it was trading at around $7,500. As bitcoin’s value has risen, its easy divisibility (the ability to buy a small fraction of one bitcoin) has become a key attribute. One bitcoin is currently divisible to eight decimal places (100 millionths of one bitcoin); the bitcoin community refers to the smallest unit as a ‘Satoshi.’

Nakamoto set the network up so that the number of bitcoin will never exceed 21 million, ensuring scarcity. There are currently around 3 million bitcoin still available to be mined, which will happen more and more slowly. The last blocks will theoretically be mined in 2140.

Cryptocurrencies and traditional currencies share some traits — like how you can use them to buy things or how you can transfer them electronically — but they’re also different in interesting ways. Here are a few highlights.

Bitcoin is the world’s first completely open payment network which anyone with an internet connection can participate in.

Key question

How does bitcoin have value?

Essentially the same way a traditional currency does – because it’s proven itself to be a viable and convenient way to store value, which means it can easily be traded for goods, services, or other assets. It’s scarce, secure, portable (compared to, say, gold), and easily divisible, allowing transactions of all sizes.

How to invest with Bitcoin

The easiest way to invest with bitcoin is to invest with an online platform like Coinbayuk. Coinbayuk makes it easy to buy, sell, send, receive, and store bitcoin without needing to hold it yourself using something called public and private keys.

However, if you choose to buy and store bitcoin outside of an online exchange, here’s how that works.

Each person who joins the bitcoin network is issued a public key, which is a long string of letters and numbers that you can think of like an email address, and a private key, which is equivalent to a password.

When you buy bitcoin—or send/receive it—you get a public key, which you can think of as a key that unlocks a virtual vault and gives you access to your money.

Anyone can send bitcoin to you via your public key, but only the holder of the private key can access the bitcoin in the “virtual vault” once it’s been sent.

There are many ways to store bitcoin both online and off. The simplest solution is a virtual wallet.

If you want to transfer money from your wallet to a bank account after selling your bitcoin, there are apps that makes it as easy for transferring funds from one bank to another. Similar to conventional bank transfers or ATM withdrawals, some exchanges set a daily limit, and it may take between a few days and a week for the transaction to be completed.

The easiest way to buy bitcoin is to purchase it through an online exchange.

Key question

What’s the difference between Bitcoin and Blockchain?

All bitcoin transactions and public keys are recorded on a virtual ledger called the blockchain. The ledger is effectively a chronological list of transactions. This ledger is copied—exactly—across every computer that is connected to the bitcoin network, and it is constantly checked and secured using a vast amount of computing power across the globe. The blockchain concept has turned out to be powerful and adaptable, and there are now a wide variety of non-cryptocurrency-related blockchains that are used for things like supply-chain management. The ‘Bitcoin Blockchain’ specifically refers to the virtual ledger that records bitcoin transactions and private keys.

How to use Bitcoin

Back in 2013, a bitcoin enthusiast named Laszlo Hanyecz created a message-board post offering 10,000 BTC – which then was worth around $25 – to anyone who would deliver two pizzas to his Jacksonville, Florida, home. As the legend goes, those two pizzas, which another bitcoin early-adopter bought from a local Papa John’s, marked the first successful purchase of non-virtual goods using bitcoin. Thankfully it’s a lot easier to use bitcoin these days!

It’s simple: Transactions using BTC aren’t that different from those using a credit or debit card, but instead of being asked to enter card info, you’ll simply be entering the payment amount and the vendor’s public key (similar to an email address) via a wallet app. (When transacting in person using smartphones or tablets, often a QR code will pop up to simplify the process – when you scan the code, your wallet app will automatically enter the pertinent information.)

It’s private: One of the benefits of paying with bitcoin is that doing so limits the amount of personal information you need to provide. The only time you need to share your name and address is if you’re purchasing physical goods that need to be shipped.

It’s flexible: As to what you should do with your bitcoin, that depends completely on your personal interests. Here are some ideas:

You can sell it for cash using an exchange or a Bitcoin ATM.

You can spend it online or in brick-and-mortar retailers as you would any other currency by using a Bitcoin debit card.

You can hold on to some or all of it as part of your investment and savings strategy.

You might choose to that is close to your heart (check out).

And if you have a serious budget and unfulfilled astronaut dreams? Richard Branson’s Virgin Galactic happily accepts BTC in exchange for the opportunity to blast off on one of its forthcoming space-tourism missions.

Due to the cryptographic nature of the Bitcoin network, bitcoin payments are fundamentally more secure than standard debit/credit card transactions.

What makes Bitcoin a new kind of money?

Bitcoin is global. You can send it across the planet as easily as you can pay with cash in the physical world. It isn’t closed on weekends, doesn’t charge you a fee to access your money, and doesn’t impose any arbitrary limits.

Bitcoin is irreversible. Bitcoin is like cash, in the sense that transactions cannot be reversed by the sender. In comparison, credit cards, conventional online payment systems, and banking transactions can be reversed after the payment has been made—sometimes months after the initial transaction—due to the centralized intermediaries that complete the transactions. This creates higher fraud risk for merchants, which can lead to higher fees for using credit cards.

Bitcoin is private. When paying with bitcoin, there are no bank statements, or any need to provide unnecessary personal information to the merchant. Bitcoin transactions don’t contain any identifying information other than the bitcoin addresses and amounts involved.

Bitcoin is secure. Due to the cryptographic nature of the Bitcoin network, bitcoin payments are fundamentally more secure than standard debit/credit card transactions. When making a bitcoin payment, no sensitive information is required to be sent over the internet. There is a very low risk of your financial information being compromised, or having your identity stolen.

Bitcoin is open. Every transaction on the Bitcoin network is published publicly, without exception. This means there’s no room for manipulation of transactions (save for a highly unlikely 51% attack scenario) or changing the supply of bitcoin. The software that constitutes the core of Bitcoin is free and open-source so anyone can review the code.

Bitcoin is safe. In more than ten years of existence, the bitcoin network has never been successfully hacked. And because the system is permissionless and open-sourced, countless computer scientists and cryptographers have been able to examine all aspects of the network and its security.

Where does Bitcoin come from?

Bitcoin is virtually ‘mined’ by a vast, decentralized (also referred to as ‘peer-to-peer’) network of computers that are constantly verifying and securing the accuracy of the blockchain. Every single bitcoin transaction is reflected on that ledger, with new information periodically gathered together in a “block,” which is added to all the blocks that came before.

What is a bull or bear market?

Definition

Markets experiencing sustained and/or substantial growth are called bull markets. Markets experiencing sustained and/or substantial declines are called bear markets. Each presents its own set of opportunities and pitfalls

Whether you’re looking into cryptocurrency, stocks, real estate, or any other asset, you’ll often see markets described in one of two ways: as a bull market or a bear market. To put it simply, a bull market is a rising market, while a bear market is a declining one. Because markets often experience day-to-day (or even moment-to-moment) volatility, both terms are generally reserved for:

-

Longer periods of mostly upward or downward movement

-

Substantial upward or downward swings (20% is the widely accepted figure)

So, what is a bull market?

A bull market, or bull run, is defined as a period of time where the majority of investors are buying, demand outweighs supply, market confidence is at a high, and prices are rising. If, in a given market, you see prices quickly trending upwards, this could be a sign that the majority of investors are becoming optimistic or “bullish” about the price increasing further, and may mean that you’re looking at the start of a bull market.

Investors who believe that prices will increase over time are known as “bulls.” As investor confidence rises, a positive feedback loop emerges, which tends to draw in further investment, causing prices to continue to rise.

Because the price of a given cryptocurrency is substantially influenced by public confidence in that asset, a strategy some investors use is to try to determine investors’ optimism in a given market (a measure known as “market sentiment”).

What marks the end of a bull market?

Even during a bull market there will be fluctuations, dips, and corrections along the way. It can be easy to misinterpret short-term downward movements as the end of a bull market. This is why it’s important to consider any potential signs for a trend reversal from a broader perspective, looking at price action over longer time frames. (Investors with a shorter time-frame often talk about “buying the dip.”)

History has shown that bull markets don’t last forever, and at some point, investor confidence will begin to decline — this could be triggered by anything from bad news like unfavorable legislation to unforeseen circumstances like the COVID-19 pandemic. A sharp downwards price movement can begin a bear market, where more and more investors believe prices will continue to fall, causing a downward spiral as they sell in order to prevent further losses.

What is a bear market?

Bear markets are defined as a period of time where supply is greater than demand, confidence is low, and prices are falling. Pessimistic investors who believe prices will continue to fall are, therefore, referred to as “bears.” Bear markets can be difficult to trade in — particularly for inexperienced traders.

It’s notoriously difficult to predict when the bear market might end and when the bottom price has been reached — as rebounding is usually a slow and unpredictable process that can be influenced by many external factors such as economic growth, investor psychology, and world news or events.

But they also can present opportunities. After all, if your investment strategy is longer-term, buying during a bear market can pay off when the cycle reverses itself. Investors with shorter-term strategies can also be on the lookout for temporary price spikes or corrections. And for more advanced investors, there are strategies like short selling, which is a way of betting that an asset will decline in price. Another strategy many crypto investors employ is dollar-cost averaging, in which you’d invest a set amount of money (say $50) every week or month, whether the asset is rising or falling. This distributes your risk and allows you to invest through bull and bear markets alike.

Where did these “bull” and “bear” terms come from, anyway?

Like a lot of financial terms, the origins aren’t clear. But most people believe they derive from the way each animal attacks: bulls thrust their horns upward, while bears swipe downwards with their claws. There is of, course, a long history of theory and evidence around the origin of the terms. If you’re curious, this Merriam-Webster explainer is a good place to start.

- How to set up a crypto wallet

A crypto wallet is a place where you can securely keep your crypto. There are many different types of crypto wallets, but the most popular ones are hosted wallets, non-custodial wallets, and hardware wallets.

Which one is right for you depends on what you want to do with your crypto and what kind of safety net you want to have.

Hosted wallets

The most popular and easy-to-set-up crypto wallet is a hosted wallet. When you buy crypto using an app like Coinbase, your crypto is automatically held in a hosted wallet. It’s called hosted because a third party keeps your crypto for you, similar to how a bank keeps your money in a checking or savings account. You may have heard of people “losing their keys” or “losing their USB wallet” but with a hosted wallet you don’t have to worry about any of that.

The main benefit of keeping your crypto in a hosted wallet is if you forget your password, you won’t lose your crypto. A drawback to a hosted wallet is you can’t access everything crypto has to offer. However, that may change as hosted wallets start to support more features.

How to set up a hosted wallet:

Choose a platform you trust. Your main considerations should be security, ease of use, and compliance with government and financial regulations.

Create your account. Enter your personal info and choose a secure password. It’s also recommended to use 2-step verification (also called 2FA) for an extra layer of security.

Buy or transfer crypto. Most crypto platforms and exchanges allow you to buy crypto using a bank account or credit card. If you already own crypto, you can also transfer it to your new hosted wallet for safe keeping.

Non-custodial wallets

A non-custodial wallet, like Coinbase Wallet or MetaMask, puts you in complete control of your crypto. Non-custodial wallets don’t rely on a third party — or a “custodian” — to keep your crypto safe. While they provide the software necessary to store your crypto, the responsibility of remembering and safeguarding your password falls entirely on you. If you lose or forget your password — often referred to as a “private key” or “seed phrase” — there’s no way to access your crypto. And if someone else discovers your private key, they’ll get full access to your assets.

Why have a non-custodial wallet? In addition to being in full control of the security of your crypto, you can also access more advanced crypto activities like yield farming, staking, lending, borrowing, and more. But if all you want to do is buy, sell, send, and receive crypto, a hosted wallet is the easiest solution.

How to set up a non-custodial wallet:

Download a wallet app. Popular options include Coinbase Wallet and MetaMask.

Create your account. Unlike a hosted wallet, you don’t need to share any personal info to create a non-custodial wallet. Not even an email address.

Be sure to write down your private key. It’s presented as a random 12-word phrase. Keep it in a secure location. If you lose or forget this 12-word phrase you won’t be able to access your crypto.

Transfer crypto to your wallet. It’s not always possible to buy crypto using traditional currencies (like US dollars or Euros) with a non-custodial wallet, so you’ll need to transfer crypto into your non-custodial wallet from elsewhere.

If you’re a Coinbase customer, you have your choice of a hosted wallet or a non-custodial wallet. The Coinbase app, where you buy and sell crypto, is a hosted wallet. You can also download the standalone Coinbase Wallet app to take advantage of the benefits of a non-custodial wallet. Some of our customers have both, making it easy to buy crypto with traditional currency as well as participate in advanced crypto activities. Setting up either wallet is free.

Hardware wallets

A hardware wallet is a physical device, about the size of a thumb drive, that stores the private keys to your crypto offline. Most people don’t use hardware wallets because of their increased complexity and cost, but they do have some benefits — for example, they can keep your crypto secure even if your computer is hacked. However, this advanced security makes them inconvenient to use compared to a software wallet and they can cost upwards of $100 to buy.

How to set up a hardware wallet:

Buy the hardware. The two most well-known brands are Ledger and Trezor.

Install the software. Each brand has their own software that’s needed to set up your wallet. Download the software from the official company website and follow the instructions to create your wallet.

Transfer crypto to your wallet. Similar to a non-custodial wallet, a hardware wallet typically doesn’t allow you to buy crypto using traditional currencies (like US dollars or Euros), so you’ll need to transfer crypto to your wallet.

Just as there are many ways to store cash (in a bank account, in a safe, under the bed), there are many ways to store crypto. You can keep things simple with a hosted wallet, have full control of your crypto with a non-custodial wallet, take extra precautions with a hardware wallet, or even have multiple types of wallets — with crypto the choice is yours.

Add Your Heading Text Here

What is cryptocurrency?

Bitcoin, Ethereum, and other crypto are revolutionizing how we invest, bank, and use money. Read this beginner’s guide to learn more.

At its core, cryptocurrency is typically decentralized digital money designed to be used over the internet. Bitcoin, which launched in 2008, was the first cryptocurrency, and it remains by far the biggest, most influential, and best-known. In the decade since, Bitcoin and other cryptocurrencies like Ethereum have grown as digital alternatives to money issued by governments.

The most popular cryptocurrencies, by market capitalization, are Bitcoin, Ethereum, Bitcoin Cash and Litecoin. Other well-known cryptocurrencies include Tezos, EOS, and ZCash. Some are similar to Bitcoin. Others are based on different technologies, or have new features that allow them to do more than transfer value.

Crypto makes it possible to transfer value online without the need for a middleman like a bank or payment processor, allowing value to transfer globally, near-instantly, 24/7, for low fees.

Cryptocurrencies are usually not issued or controlled by any government or other central authority. They’re managed by peer-to-peer networks of computers running free, open-source software. Generally, anyone who wants to participate is able to.

If a bank or government isn’t involved, how is crypto secure? It’s secure because all transactions are vetted by a technology called a blockchain.

A cryptocurrency blockchain is similar to a bank’s balance sheet or ledger. Each currency has its own blockchain, which is an ongoing, constantly re-verified record of every single transaction ever made using that currency.

Unlike a bank’s ledger, a crypto blockchain is distributed across participants of the digital currency’s entire network

No company, country, or third party is in control of it; and anyone can participate. A blockchain is a breakthrough technology only recently made possible through decades of computer science and mathematical innovations.

Most importantly, cryptocurrencies allow individuals to take complete control over their assets

KEY TERMS AND CONCEPTS

Transferability Crypto makes transactions with people on the other side of the planet as seamless as paying with cash at your local grocery store.

Privacy When paying with cryptocurrency, you don’t need to provide unnecessary personal information to the merchant. Which means your financial information is protected from being shared with third parties like banks, payment services, advertisers, and credit-rating agencies. And because no sensitive information needs to be sent over the internet, there is very little risk of your financial information being compromised, or your identity being stolen.

Security Almost all cryptocurrencies, including Bitcoin, Ethereum, Tezos, and Bitcoin Cash are secured using technology called a blockchain, which is constantly checked and verified by a huge amount of computing power.

Portability Because your cryptocurrency holdings aren’t tied to a financial institution or government, they are available to you no matter where you are in the world or what happens to any of the global finance system’s major intermediaries.

Transparency Every transaction on the Bitcoin, Ethereum, Tezos, and Bitcoin Cash networks is published publicly, without exception. This means there’s no room for manipulation of transactions, changing the money supply, or adjusting the rules mid-game.

Irreversibility Unlike a credit card payment, cryptocurrency payments can’t be reversed. For merchants, this hugely reduces the likelihood of being defrauded. For customers, it has the potential to make commerce cheaper by eliminating one of the major arguments credit card companies make for their high processing fees.

Safety The network powering Bitcoin has never been hacked. And the fundamental ideas behind cryptocurrencies help make them safe: the systems are permissionless and the core software is open-source, meaning countless computer scientists and cryptographers have been able to examine all aspects of the networks and their security.

Utility Unlike a credit card payment, cryptocurrency payments can’t be reversed. For merchants, this hugely reduces the likelihood of being defrauded. For customers, it has the potential to make commerce cheaper by eliminating one of the major arguments credit card companies make for their high processing fees.

Why is cryptocurrency the future of finance?

Cryptocurrencies are the first alternative to the traditional banking system, and have powerful advantages over previous payment methods and traditional classes of assets. Think of them as Money 2.0. — a new kind of cash that is native to the internet, which gives it the potential to be the fastest, easiest, cheapest, safest, and most universal way to exchange value that the world has ever seen.

-

Cryptocurrencies can be used to buy goods or services or held as part of an investment strategy, but they can’t be manipulated by any central authority, simply because there isn’t one. No matter what happens to a government, your cryptocurrency will remain secure.

-

Digital currencies provide equality of opportunity, regardless of where you were born or where you live. As long as you have a smartphone or another internet-connected device, you have the same crypto access as everyone else.

-

Cryptocurrencies create unique opportunities for expanding people’s economic freedom around the world. Digital currencies’ essential borderlessness facilitates free trade, even in countries with tight government controls over citizens’ finances. In places where inflation is a key problem, cryptocurrencies can provide an alternative to dysfunctional fiat currencies for savings and payments.

-

As part of a broader investment strategy, crypto can be approached in a wide variety of ways. One approach is to buy and hold something like bitcoin, which has gone from virtually worthless in 2008 to thousands of dollars a coin today. Another would be a more active strategy, buying and selling cryptocurrencies that experience volatility.

-

Bitcoin is currently the most valuable cryptocurrency as measured by market cap. It’s also the most popular and the best-known. The current price of bitcoin, Ethereum, Tezos, Bitcoin Cash and other

-

One option for crypto-curious investors looking to minimize risk is USD Coin, which is pegged 1:1 to the value of the U.S. dollar. It offers the benefits of crypto, including the ability to transfer money internationally quickly and cheaply, with the stability of a traditional currency. Coinbase customers that hold USDC earn rewards, making it an appealing alternative to a traditional savings account.

Digital currencies provide equality of opportunity, regardless of where you were born or where you live.

Why invest your cryptocurrency on CoinbayUK?

Online platforms like Coinbayuk have made investments and profitability of cryptocurrencies easy, secure, and rewarding.

-

It only takes a few minutes to create a secure account.

-

You can buy as little (or as much) crypto as you want, since you can buy fractional coins.

-

Many digital currencies, including USD Coin and Tezos, offer holders rewards just for having them.

-

On Coinbayuk, you can earn over 15% profit— that’s much higher than most traditional trading and investment accounts

-

Unlike stocks or bonds, you can easily transfer your cryptocurrency to anyone else or use it to pay for goods and services.

-

Millions of people hold bitcoin and other digital currencies as part of their investment portfolios.

What is a stablecoin?

USD Coin is an example of a cryptocurrency called stablecoins. You can think of these as crypto dollars—they’re designed to minimize volatility and maximize utility. Stablecoins offer some of the best attributes of cryptocurrency (seamless global transactions, security, and privacy) with the valuation stability of fiat currencies.

-

Stablecoins do this by pegging their value to an external factor, typically a fiat currency like the U.S. dollar or a commodity like gold.

-

As a result, their valuations are less likely to shift dramatically from day to day. That stability can increase their utility for everyday use as money, because both buyers and merchants can be confident that the value of their transaction will remain relatively consistent over a longer timeframe.

-

They can also work as a safe and stable way to save money, like a traditional savings account.

Key question

What is the future of cryptocurrency?

Experts often talk about the ways crypto can provide solutions to the shortcomings of our current financial system. High fees, identity theft, and extreme economic inequality are an unfortunate part of our current financial system and they’re also things cryptocurrencies have the potential to address. The technology that powers digital currencies also has wide-ranging potential beyond the financial industry, from revolutionizing supply chains to building the new, decentralized internet.

How does cryptocurrency work?

Bitcoin is the first and most well-known, but there are thousands of types of cryptocurrencies. Many, like Litecoin and Bitcoin Cash, share Bitcoin’s core characteristics but explore new ways to process transactions. Others offer a wider range of features. Ethereum, for example, can be used to run applications and create contracts. All four, however, are based on an idea called the blockchain, which is key to understanding how cryptocurrency works.

-

At its most basic, a blockchain is a list of transactions that anyone can view and verify. The Bitcoin blockchain, for example, is a record of every time someone sends or receives bitcoin. This list of transactions is fundamental for most cryptocurrencies because it enables secure payments to be made between people who don’t know each other without having to go through a third-party verifier like a bank.

-

Blockchain technology is also exciting because it has many uses beyond cryptocurrency. Blockchains are being used to explore medical research, improve the sharing of healthcare records, streamline supply chains, increase privacy on the internet, and so much more.

-

The principles behind both bitcoin and the Bitcoin blockchain first appeared online in a white-paper published in late 2007 by a person or group going by the name Satoshi Nakamoto.

-

The blockchain ledger is split across all the computers on the network, which are constantly verifying that the blockchain is accurate.This means there is no central vault, entity, or database that can be hacked, stolen, or manipulated.

Key concept

Cryptocurrencies use a technology called public-private key cryptography to transfer coin ownership on a secure and distributed ledger. A private key is an ultra secure password that never needs to be shared with anyone, with which you can send value on the network. An associated public key can be freely and safely shared with others to receive value on the network. From the public key, it is impossible for anyone to guess your private key.

What is cryptocurrency mining?

Most cryptocurrencies are ‘mined’ via a decentralized (also known as peer-to-peer) network of computers. But mining doesn’t just generate more bitcoin or Ethereum – it’s also the mechanism that updates and secures the network by constantly verifying the public blockchain ledger and adding new transactions.

-

Technically, anyone with a computer and an internet connection can become a miner. But before you get excited, it’s worth noting that mining is not always profitable. Depending on which cryptocurrency you’re mining, how fast your computer is, and the cost of electricity in your area, you may end up spending more on mining than you earn back in cryptocurrency.

-

As a result, most crypto mining these days is done by companies that specialize in it, or by large groups of individuals who all contribute their computing power.

-

How does the network encourage miners to participate in maintaining the blockchain? Again, taking Bitcoin as an example, the network holds a lottery in which all the mining rigs around the world race to become the first to solve a math problem, which also verifies and updates the blockchain with new transactions. Each winner is awarded new bitcoin, which can then make its way into the broader marketplace.

Key question

Where do cryptocurrencies get their value?

The economic value of cryptocurrency, like all goods and services, comes from supply and demand.

Supply refers to how much is available—like how many bitcoin are available to buy at any moment in time. Demand refers to people’s desire to own it—as in how many people want to buy bitcoin and how strongly they want it. The value of a cryptocurrency will always be a balance of both factors.

There are also other types of value. For example, there’s the value you get from using a cryptocurrency. Many people enjoy spending or gifting crypto, meaning that it gives them a sense of pride to support an exciting new financial system. Similarly, some people like to shop with bitcoin because they like its low fees and want to encourage businesses to accept it.

How to buy bitcoin and other cryptocurrency

The easiest way to acquire cryptocurrency is to purchase on an online exchange.

On crypto exchange platforms, you can buy major cryptocurrencies like

-

Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), Bitcoin Cash (BCH), Ethereum Classic (ETC). Or you can explore emerging coins like Stellar Lumens or EOS. For some cryptocurrencies Coinbase offers opportunities to earn some for free.)

-

One good approach is to ask yourself what you’re hoping to do with crypto and choose the currency that will help you achieve your goals. For example, if you want to buy a laptop with crypto, bitcoin might be a good option because it is the most widely accepted cryptocurrency. On the other hand, if you want to play a digital card game, then Ethereum is a popular choice.

How do you store cryptocurrency?

Storing crypto is similar to storing cash, which means you need to protect it from theft and loss. There are many ways to store crypto both online and off, but the simplest solution is via a trusted, secure exchange like Coinbayuk.

-

Coinbayuk customers can securely store, send, receive, and convert crypto by signing into their account on a computer, tablet, or phone.

-

Want to transfer money from your wallet to a bank account? The Coinbayuk app makes it as easy as transferring funds from one bank to another. (Much like conventional bank transfers or ATM withdrawals, exchanges like Coinbayuk set a daily limit, and it might take from a few days to a week for the transaction to be completed.

What can you do with cryptocurrency?

There’s a wide range of things you can do with cryptocurrency, and the list grows with time. Here are a few ways to get started, from participating in everyday activities to exploring new technological frontiers:

-

Shop: Over 8,000 global merchants accept cryptocurrency.

-

Travel the world: Because cryptocurrency isn’t tied to a specific country, traveling with crypto can cut down on money exchange fees. There’s already a small but thriving community of self-titled “crypto nomads” who primarily, or in some cases exclusively, spend crypto when they travel.

-

Donate to causes: There are benefits to donating and accepting crypto, and many nonprofit organizations accept bitcoin donations.

-

Gift it: Cryptocurrency makes a great gift for friends and family who are interested in learning about new technology.

-

Tip someone: Authors, musicians, and other online content creators sometimes leave Bitcoin addresses or QR codes at the end of their articles. If you like their work, you can give a little crypto as a way of saying thanks.

-

Explore unique new combinations of money and technology: Orchid is a VPN, which helps protect you when you’re online, and a digital currency at the same time. Basically it’s broken down into two parts, the Orchid VPN app and the OXT cryptocurrency, and it all runs on the Ethereum network.

-

Travel the world: Because cryptocurrency isn’t tied to a specific country, traveling with crypto can cut down on money exchange fees. There’s already a small but thriving community of self-titled “crypto nomads” who primarily, or in some cases exclusively, spend crypto when they travel.

-

Buy property in a virtual gaming world: Decentraland, which also runs on the Ethereum blockchain, is the first virtual world entirely owned by its users. Users can buy and sell land, avatar clothing, and all kinds of other stuff while partying in virtual nightclubs or mingling in virtual art galleries.

-

Explore decentralized finance, or DeFi: A wide variety of new players are aiming to recreate the entire global financial system, from mutual-fund-like investments to loan-lending mechanisms and way beyond, without any central authorities

Market Cap

Within the blockchain industry, the term market capitalization (or market cap) refers to a metric that measures the relative size of a cryptocurrency. It is calculated by multiplying the current market price of a particular coin or token with the total number of coins in circulation.

Market Cap = Current Price x Circulating Supply

For example, if each unit of a cryptocurrency is being traded at $10.00, and the circulating supply is equal to 50,000,000 coins, the market capitalization for this cryptocurrency would be $500,000,000.

While the market cap may offer some insights about the size and performance of a company or cryptocurrency project, it is important to note that it is not the same as money inflow. So, it does not represent how much money is in the market. This is a common misconception because the calculation of market cap is directly dependent on price, but in fact, a relatively small variation in price may affect the market cap significantly.

Considering the previous example, a few millions of dollars could potentially pump the cryptocurrency price from $10.00 to $15.00, which would cause the market cap to increase from $500,000,000 to $750,000,000. However, this doesn’t mean there was an inflow of $250,000,000 in the market. Actually, the amount of money needed to cause such an increase in price is dependent on volume and liquidity, which are distinct but related concepts.

While volume relates to the number of assets exchanged within a certain period, liquidity is basically the degree to which the asset can be quickly bought or sold without causing too much impact on the price.

Simply put, a high-volume and liquid market cannot be easily manipulated because there are many orders in the order book and possibly a big volume of orders within the different ranges of price. This would result in a less volatile market, meaning that a whale would need a lot of money to significantly manipulate the price.

In contrast, a thin order book of a low-volume market could be easily overpassed with a relatively small amount of money, causing a significant impact on both the price and market cap.

Crypto resources: What to read, watch, and stream in crypto

A little more than a decade ago, Bitcoin emerged as a new kind of money designed for the internet – giving people on opposite sides of the world the ability to exchange value without governments, banks, or anyone else in the middle. In the years since, it’s evolved into an asset worth hundreds of billions of dollars and sparked an entirely new, constantly evolving crypto universe.

If you’re seeking a deeper understanding of all things crypto, you’ve come to the right place. We’ve gathered some of the smartest, most essential resources the internet has to offer: YouTube clips that can help you grapple with arcane concepts, podcast interviews with foundational figures, and the Bitcoin white paper — the document that started it all.

(Just looking for the basics? We’ve got you covered, too. Check out Coinbase’s essential guides to Bitcoin, blockchains, setting up a wallet, getting into DeFi, and more.)

The case for Bitcoin and the rise of digital money

The best way to understand crypto — how a blockchain works, why it matters, how the space has evolved — is to start with Bitcoin. The original cryptocurrency continues to dominate all other forms of digital money—it’s most people’s gateway to the wider crypto world, and its technology provides the foundation for a lot of what came after. Here are some of the best explanations of what Bitcoin is and how it gave rise to the entire crypto ecosystem.

Explain Bitcoin Like I’m Five (Angel investor Nik Custodio does exactly what the title says)

Ben Horowitz explains the rise of crypto (a 3 minute explanation of crypto’s potential)

But how does Bitcoin actually work? (Invaluable, easy-to-understand YouTube explainer)

An Intro to Crypto: Building Blocks (Crypto venture-fund founder and former Coinbase Product Manager Linda Xie breaks down the core concepts linking Bitcoin, Ethereum, and more)

Why Bitcoin Matters (Marc Andreessen, investor and Coinbase board member, makes the case for digital money in a 2014 New York Times essay )

The Internet of Money (Investor Naval Ravikant’s Wired article that introduced a lot of people to Bitcoin’s wider potential)

Bitcoin whitepaper: A Peer-to-Peer Electronic Cash System (Satoshi Nakamoto’s 2009 whitepaper that started it all – technical, but more readable than you’d assume)

Cryptocurrency: The Future of Finance and Money (In this four-minute video, experts from Coinbase and across the crypto universe dive into the democratizing potential of cryptocurrency)

Why (and how) you should think about investing in Bitcoin

In a remarkably short period of time, Bitcoin’s market cap has gone from essentially zero to nearly $200 billion (as of November 2020). If you want to understand where Bitcoin has been and where it’s headed, we’ve gathered insights from some of crypto’s biggest and smartest investors.

Bitcoin for the open minded skeptic (Crypto VC specialists Paradigm break down the essentials of Bitcoin for investors )

The Great Monetary Inflation (Hedge fund pioneer Paul Tudor Jones shares his crypto strategy in this much-circulated investors’ letter)

The Case for Bitcoin (Excellent, useful, and constantly updated mix of data and analysis)

Bitcoin’s Killer App (Deep dive on investing and blockchains from crypto fund Pantera Capital)

Why MicroStrategy invested $500 million in bitcoin (Thorough YouTube interview with Microstrategy CEO Michael Saylor)

Ethereum and other coins

Ethereum took Bitcoin’s blockchain idea and made it more flexible – allowing it to power everything from games to tools that are creating an entire decentralized alternative to the financial system. But while it might be the second-biggest digital currency by market cap, it’s certainly not the only Bitcoin alternative. Learn about Ether and other altcoins here.

Ethereum in 25 minutes (Ethereum cofounder Vitalik Buterin explains the basics in this YouTube talk)

The evolution of Ethereum (Want to go deeper? This guide from the Ethereum Foundation will take you there.)

Ethereum whitepaper: A Next-Generation Smart Contract and Decentralized Application Platform (The original 2013 document proposing the world’s first programmable blockchain)

Beginners Guide to Cryptoassets (Linda Xie’s guide to Monero, Tezos, Zcash and more)

The 10 Most Important Cryptocurrencies other than Bitcoin (Investopedia’s guide to some of the most popular altcoins)

Core concepts

If you want to really understand crypto you need to understand the technology behind it. Get schooled on key concepts from blockchains and decentralization to smart contracts and more.

What is Blockchain: the Complete Wired Guide (Highly readable explainer from the tech magazine)

Why (TF) Blockchain? (Interesting take from software engineer and crypto investment fund manager Aleksandr Bulkin)

The Meaning of Decentralization (Vitalik Buterin explains why it’s more than just a crypto buzzword)

Why decentralization matters (a16z partner Chris Dixon explores the next phase of the internet)

Thoughts on tokens (Angel investor and former Coinbase CTO Balaji Srinivasan on how Bitcoin’s token concept could change the internet)

Best crypto podcasts

Want to take your crypto education offscreen and hear about the latest developments? These crypto podcasts offer behind-the-scenes stories and interviews with key players.

Hash Power: A documentary on blockchains and cryptocurrencies (Three-part audio documentary the crypto universe)

Bankless (“Guide to crypto finance” in podcast form)

Epicenter (Long-running podcast on all things crypto)

Unchained (Laura Shin’s popular “no hype” crypto resource)

And more…

Check out the lists that inspired this guide, created and maintained by crypto investors. They’re full of valuable (if sometimes quite technical) material.

a16z Crypto Canon (Venture giant Andreessen Horowitz’s crypto fun maintains this mega list of crypto articles)

Dan Romero’s Crypto Reading (Angel investor and former Coinbase Vice President Dan Romero chronicles crypto history via his list of essential links)

What is DeFi?

Definition

Short for decentralized finance, DeFi is an umbrella term for peer-to-peer financial services on public blockchains, primarily Ethereum.

DeFi (or “decentralized finance”) is an umbrella term for financial services on public blockchains, primarily Ethereum. With DeFi, you can do most of the things that banks support — earn interest, borrow, lend, buy insurance, trade derivatives, trade assets, and more — but it’s faster and doesn’t require paperwork or a third party. As with crypto generally, DeFi is global, peer-to-peer (meaning directly between two people, not routed through a centralized system), pseudonymous, and open to all.

Why is DeFi important?

DeFi takes the basic premise of Bitcoin — digital money — and expands on it, creating an entire digital alternative to Wall Street, but without all the associated costs (think office towers, trading floors, banker salaries). This has the potential to create more open, free, and fair financial markets that are accessible to anyone with an internet connection.

What are the benefits?

Open: You don’t need to apply for anything or “open” an account. You just get access by creating a wallet.

Pseudonymous: You don’t need to provide your name, email address, or any personal information.

Flexible: You can move your assets anywhere at any time, without asking for permission, waiting for long transfers to finish, and paying expensive fees.

Fast: Interest Rates and rewards often update rapidly (as quickly as every 15 seconds), and can be significantly higher than traditional Wall Street.

Transparent: Everyone involved can see the full set of transactions (private corporations rarely grant that kind of transparency)

How does it work?

Users typically engage with DeFi via software called dapps (“decentralized apps”), most of which currently run on the Ethereum blockchain. Unlike a conventional bank, there is no application to fill out or account to open.

Here are some of the ways people are engaging with DeFi today:

Lending: Lend out your crypto and earn interest and rewards every minute – not once per month.

Getting a loan: Obtain a loan instantly without filling in paperwork, including extremely short-term “flash loans” that traditional financial institutions don’t offer.

Trading: Make peer-to-peer trades of certain crypto assets — as if you could buy and sell stocks without any kind of brokerage.

Saving for the future: Put some of your crypto into savings account alternatives and earn better interest rates than you’d typically get from a bank.

Buying derivatives: Make long or short bets on certain assets. Think of these as the crypto version of stock options or futures contracts.

What are the downsides?

Fluctuating transaction rates on the Ethereum blockchain mean that active trading can get expensive.

Depending on which dapps you use and how you use them, your investment could experience high volatility – this is, after all, new tech.

You have to maintain your own records for tax purposes. Regulations can vary from region to region.

What is a protocol?

Definition

Protocols are basic sets of rules that allow data to be shared between computers. For cryptocurrencies, they establish the structure of the blockchain — the distributed database that allows digital money to be securely exchanged on the internet.

Bitcoin entered the world in the form of a white paper written by a pseudonymous person or group going by the name of Satoshi Nakamoto. The paper, which was posted to a cryptography message board in 2008, outlined a set of computational rules that established a new kind of distributed database called a blockchain. The blockchain would work like a ledger, tracking every Bitcoin transaction, and would be self-verifying — constantly checked and secured by the computing power of the entire network. “Miners,” whose computers do the heavy lifting of maintaining the chain, would be rewarded in Bitcoin. Collectively, these rules form the Bitcoin protocol — quite literally, they are Bitcoin.

Of course, protocols aren’t exclusive to cryptocurrency. They’re fundamental to how the internet works, governing the transmission of data from one computer to another. Email, for instance, is based on several sets of protocols. The HTTP you see at the beginning of every URL? It stands for “hypertext transfer protocol.”

The Bitcoin protocol proved that digital money could be exchanged safely on the internet. In its wake, thousands of new forms of digital money, each with their own protocols, have followed. And over the subsequent decade-plus, fundamental breakthroughs in cryptography, and decentralized computation have continued to open up new possibilities for blockchain protocols.

Why are protocols important?

Protocols allow cryptocurrencies to be decentralized via the blockchain — which means they are spread across a network of computers with no central hub or authority.

The key advancement of the Bitcoin protocol was that it created digital money that can be traded or spent without anyone in the transaction worrying that the money has already been spent. (This is known as the double-spend problem, and it’s familiar to anyone who’s ever bought a concert ticket from a stranger only to discover that it’s already been scanned.)

Since Bitcoin protocol was born, subsequent rulesets have evolved to encompass a huge range of functions. There are thousands of cryptocurrencies, each with their own protocol.

The Ethereum protocol, for instance, is designed around “smart contracts” — in which a transaction or agreement automatically executes when certain criteria are met.

A vast new set of protocols that run on the Ethereum blockchain have emerged, allowing for a range of decentralized financial products that automate everything from lending and savings to insurance.

Ethereum isn’t the only “smart contract” protocol in the crypto universe — newer blockchain protocols like Polkadot have emerged to compete in the space.

COINBAY USER AGREEMENT

COINBAY USER AGREEMENT

Welcome to CoinbayUK! This is a User Agreement between you (also referred to herein as “Client,” “User,” or customer) and Coinbayuk.com (“CoinbayUK“). This User Agreement (“Agreement“) governs your use of the services provided by Coinbayuk described below (“Coinbayuk Services” or “Services“). By signing up to use an account through coinbayuk.com, APIs, or the Coinbayuk mobile application (collectively the “Coinbayuk Site“), you agree that you have read, understand, and accept all of the terms and conditions contained in this Agreement including Section 8.2. “Arbitration; Waiver of Class Action”, as well as our privacy policy, cookie policy, and E-Sign Consent Policy.

As with any asset, the value of Digital Currencies can go up or down and there can be a substantial risk that you lose money buying, selling, holding, or investing in digital currencies. You should carefully consider whether trading or holding Digital Currencies is suitable for you in light of your financial condition.

PART 1: GENERAL USE

1. Account Setup

1.1. Eligibility. To be eligible to use the Coinbayuk Services, you must be at least 18 years old.

1.2. Terms. We may amend or modify this Agreement at any time by posting the revised agreement on the Coinbayuk Site and/or providing a copy to you (a “Revised Agreement”). The Revised Agreement shall be effective as of the time it is posted but will not apply retroactively. Your continued use of the Services after the posting of a Revised Agreement constitutes your acceptance of such Revised Agreement. If you do not agree with any such modification, your sole and exclusive remedy is to terminate your use of the Services and close your account.

1.3. Registration of Coinbayuk Account. You must register for a Coinbayuk account to use the Coinbayuk Services (a “Coinbayuk Account“). By using a Coinbayuk Account you agree and represent that you will use CoinbayUK only for yourself, and not on behalf of any third party, unless you have obtained prior approval from CoinbayUK . You are fully responsible for all activity that occurs under your CoinbayUK Account. We may, in our sole discretion, refuse to open a CoinbayUK Account, or limit the number of CoinbayUK Accounts that you may hold or suspend or terminate any CoinbayUK Account or the trading of specific Digital Currency in your account.

1.4. Identity Verification. During registration for your CoinbayUK Account, you agree to provide us with the information we request for the purposes of identity verification and the detection of money laundering, terrorist financing, fraud, or any other financial crimes and permit us to keep a record of such information. You will need to complete certain verification procedures before you are permitted to use the CoinbayUK Services. Your access to one or more CoinbayUK Services and the limits that apply to your use of the CoinbayUK Services, may be altered as a result of information collected about you on an ongoing basis. The information we request may include certain personal information, including, but not limited to, your name, address, telephone number, e-mail address, date of birth, taxpayer identification number, a government identification, and information regarding your bank account (such as the name of the bank, the account type, routing number, and account number) and in some cases (where permitted by law), special categories of personal data, such as your biometric information. In providing us with this or any other information that may be required, you confirm that the information is accurate and authentic. You agree to keep us updated if any of the information you provide changes. You authorize us to make inquiries, whether directly or through third parties, that we consider necessary to verify your identity or protect you and/or us against fraud or other financial crime, and to take action we reasonably deem necessary based on the results of such inquiries. When we carry out these inquiries, you acknowledge and agree that your personal information may be disclosed to credit reference and fraud prevention or financial crime agencies and that these agencies may respond to our inquiries in full. This is an identity check only and should have no adverse effect on your credit rating. Further, you authorize your wireless operator (AT&T, Sprint, T-Mobile, US Cellular, Verizon, or any other branded wireless operator) to use your mobile number, name, address, email, network status, customer type, customer role, billing type, mobile device identifiers (IMSI and IMEI) and other subscriber status details, if available, solely to allow verification of your identity and to compare information you have provided to Coinbayuk with your wireless operator account profile information for the duration of the business relationship. See our Privacy Policy for how we treat your data.

1.5. Access. To access the CoinbayUK Services, you must have the necessary equipment (such as a smartphone or laptop) and the associated telecommunication service subscriptions to access the Internet. The CoinbayUK Services can be accessed directly using the CoinbayUK Site. Access to CoinbayUK Services may become degraded or unavailable during times of significant volatility or volume. This could result in the inability to buy or sell for periods of time and may also lead to support response time delays. Although we strive to provide you with excellent service, we do not represent that the CoinbayUK Site or other CoinbayUK Services will be available without interruption and we do not guarantee that any order will be executed, accepted, recorded, or remain open. CoinbayUK shall not be liable for any losses resulting from or arising out of transaction delays.

2. Wallet and Custodial Services

2.1. Wallet Services. As part of your Coinbayuk Account, Coinbayuk will provide qualifying and registered users access to: (a) a hosted Digital Account Dashboard for holding Digital Currencies (“Account Dashboard”).

2.2. Hosted Account Dashboard. Your Account Dashboard allows you to store, track, transfer, and manage your balances of Digital Currency. As used throughout, “Digital Currency” means only those particular digital currencies listed as available to trade or custody in your Coinbayuk Account (also referred to as . Services and supported assets may vary by jurisdiction. We securely store Accounts privately, in a combination of online and offline storage. As a result of our security protocols, it may be necessary for us to retrieve private keys or related information from offline storage in order to facilitate a Digital Currency Transfers in accordance with your instructions, and you acknowledge that this may delay the initiation or crediting of such Digital Currency Transfers. You may elect to use other services, such as the Coinbase Vault, which allow you to set withdrawal time-delays and create other conditions around the custody and transfer of your Digital Currency. Additional rules associated with such product(s) and service(s) may apply.

2.3. Supported Digital Currencies. Your Coinbayuk Account is intended solely for proper use of Supported Digital Currencies as designated on the Site. Under no circumstances should you attempt to use your Account Dashboard to store, send, request, or receive digital currencies we do not support. Coinbayuk assumes no responsibility in connection with any attempt to use your Account Dashboard with digital currencies that we do not support. If you have any questions about which Digital Currencies we currently support, please chat our support.

2.4. Supplemental Protocols Excluded. Unless specifically announced on the CoinbayUk Site or other official public statement of CoinbayUk, Supported Digital Currencies excludes all other protocols and/or functionality which supplement or interact with the Supported Digital Currency. This exclusion includes but is not limited to: metacoins, colored coins, side chains, or other derivative, enhanced, or forked protocols, tokens, or coins or other functionality, such as staking, protocol governance, and/or any smart contract functionality, which may supplement or interact with a Digital Currency we support. Do not to attempt to receive, request, send, store, or engage in any other type of transaction or functionality involving any such protocol as Coinbayuk is not configured to detect, secure, or process these transactions and functionality. Any attempted transactions in such items will result in loss of the item. You acknowledge and agree that supplemental protocols are excluded from Supported Digital Currency and that CoinbayUk has no liability for any losses related to supplemental protocols.

2.5. Digital Currency Custody and Title. All Digital Currencies held in your Account Dashboard are custodial assets for your benefit, as described in further detail below.

2.6 Ownership. Title to Digital Currency shall at all times remain with you and shall not transfer to CoinbayUk. As the owner of Digital Currency in your Account Dashboard, you shall bear all risk of loss of such Digital Currency. CoinbayUk shall have no liability for Digital Currency fluctuations. None of the Digital Currencies in your Account Dashboard are the property of, or shall or may be loaned to, CoinbayUk; CoinbayUk does not represent or treat assets in User’s Account Dashboard as belonging to CoinbayUk. CoinbayUk may not grant a security interest in the Digital Currency held in your Account Dashboard. CoinbayUk will not sell, transfer, loan, hypothecate, or otherwise alienate Digital Currency in your Account Dashboard.

2.6.1 Control. You control the Digital Currencies held in your Account Dashboard. At any time, subject to outages, downtime, and other applicable policies, you may withdraw your Digital Currency by sending it to a different blockchain address. As long as you continue to invest your Digital Currencies with Coinbayuk, Coinbayuk shall retain control over Account Dashboard associated with blockchain addresses operated by Coinbayuk.

2.6.2 Acknowledgement of Risk. You acknowledge that Digital Currency is not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.

2.6.3 Digital Currencies Not Segregated. In order to more securely custody assets, CoinbayUK may use shared blockchain addresses, controlled by CoinbayUK , to hold Digital Currencies held on behalf of customers and/or held on behalf of CoinbayUK . Although we maintain separate ledgers for Client and CoinbayUK accounts, CoinbayUK shall have no obligation to segregate by blockchain address Digital Currencies owned by you from Digital Currencies owned by other customers or by CoinbayUK .

2.7. USD Wallet. Your USD Wallet allows you to hold and transfer USD with your CoinbayUK Account as described below. In general, we will combine the balance of your USD Wallet with other customers’ balances and either hold those funds in a custodial account at a U.S. FDIC-insured bank or invest those funds in liquid investments, such as U.S. treasuries, in accordance with state money transmitter laws. CoinbayUK owns the interest or other earnings on these investments. Pooled customer funds are held apart from CoinbayUK corporate funds and CoinbayUK will neither use these funds for its operating expenses or any other corporate purposes.

3. Payment Services, Purchase & Sale Transactions, Credit Transactions

3.2. Transactions on the Coinbayuk Site. When you Invest (deposit) or withdraw Digital Currency on the Coinbayuk Site, you are not lending Digital Currency to Coinbayuk or borrowing Digital Currency from Coinbayuk. Coinbayuk acts as the agent, transacting on your behalf, to facilitate profit income through her Artificial Intelligence mining platform for you and other Coinbayuk customers.